Which is Better: HubSpot Payments vs. QuickBooks Payments?

Published on: August 7th, 2024

So, you're trying to decide between HubSpot Payments and QuickBooks Payments? It’s a tough choice, but don’t worry, we’ll break it down together. Let's dive in!

What Are HubSpot Payments?

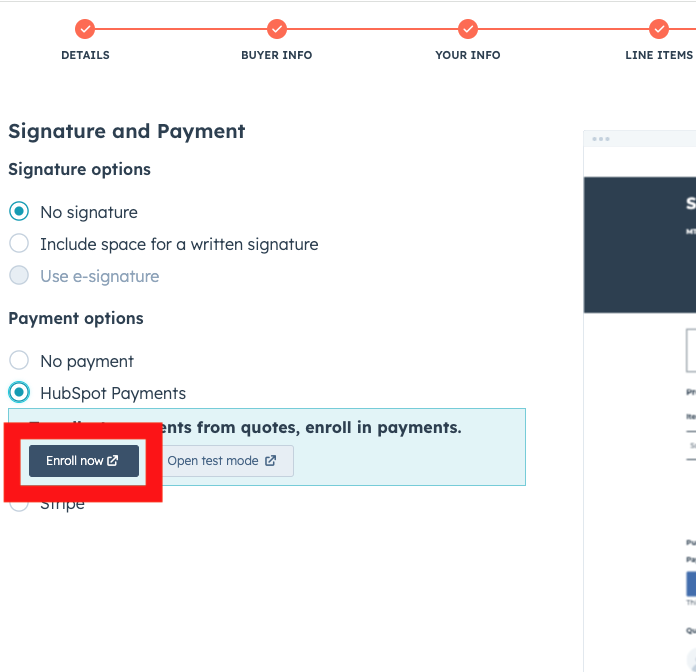

First up, let's talk about HubSpot Payments. If you’re already using HubSpot for your CRM and marketing, this might be a natural extension. Here’s what you need to know:

- Integration: Seamlessly connects with your HubSpot CRM.

- User-Friendly: Easy setup and use.

- Payment Options: Accepts credit cards and ACH payments.

- Flexibility: Can use HubSpot or Stripe for payments.

Sounds pretty good, right? But hold on, there’s more options to consider.

What Are QuickBooks Payments?

Now, onto QuickBooks Payments. If you’re managing your finances with QuickBooks, this might be your go-to. Here’s the highlights:

- Integration: Works directly with QuickBooks Online and Desktop.

- Versatile: Accepts credit cards, ACH, and even mobile payments.

- Invoice Payments: Allows customers to pay directly from invoices.

- Tracking: Automatic syncing with your accounting data.

- More Flexibility: Can use Quickbooks, Square or Stripe for payments.

So, both have their perks. Let’s see how they stack up head-to-head.

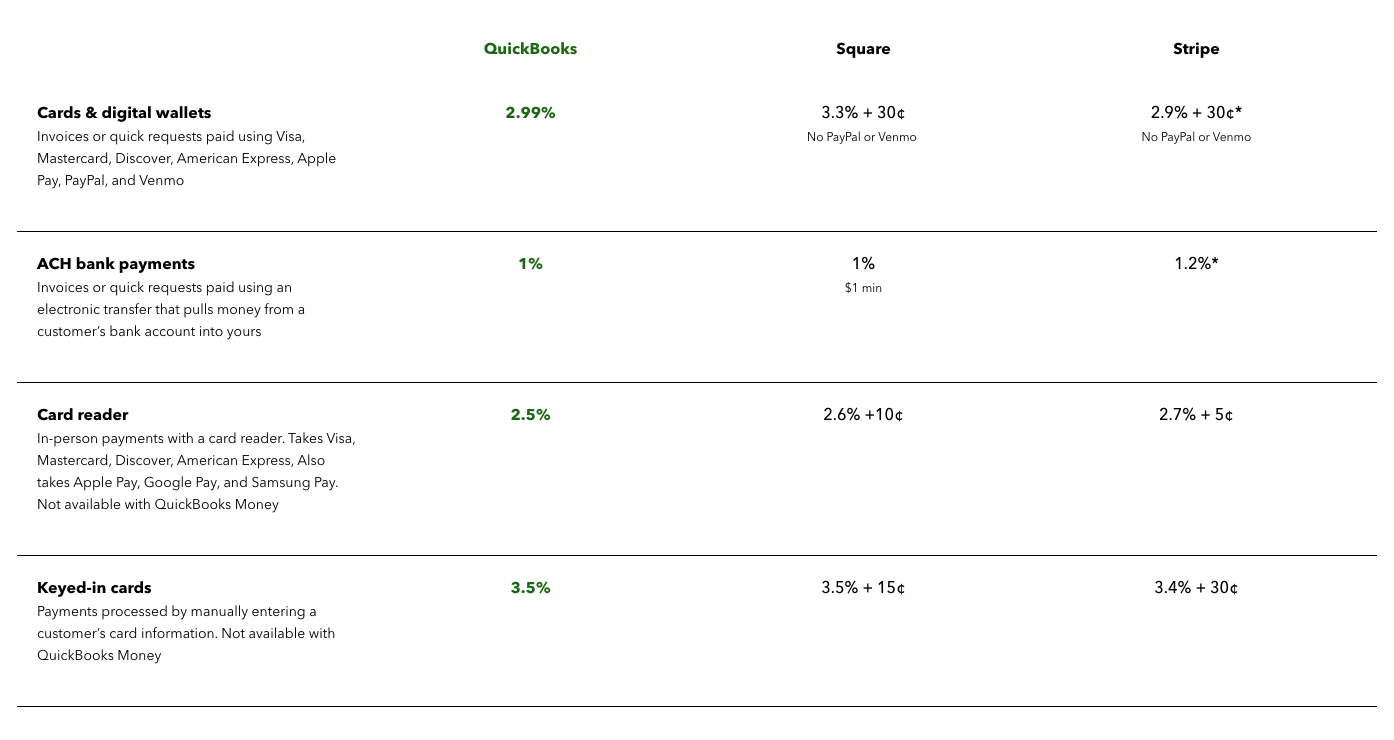

Pricing

Those processing fees can add up real quick. Here’s a full comparison:

| HubSpot Payments | QuickBooks Payments |

|---|---|

| No monthly fee, but transaction fees apply. | No monthly fee, but transaction fees apply. |

| 0.5% platform fee on all transactions. | No platform fee if using QuickBooks gateway, small fee for Stripe. |

| 2.9% + $0.30 on Debit/Credit. | 2.99% on Debit/Credit. |

| 0.8% on ACH, capped at $10. | 1.0% on ACH. |

Ease of Use

- HubSpot Payments: Super intuitive if you’re already familiar with HubSpot. Great if you’re living in the HubSpot ecosystem and your financial reporting isn't needed in (or near) real-time.

- QuickBooks Payments: Streamlined for QuickBooks users. Perfect if you’re relying on QuickBooks for accounting, reporting and decision making on a daily basis.

PCI Compliance

The payment gateways through both HubSpot and QuickBooks are PCI compliant. You can visit the FAQ section of their respective sites, linked in this paragraph if you'd like to learn more about compliance.

Benefits of Integrating HubSpot with QuickBooks

Okay, now let’s talk about the best of both worlds. Meet Slipstream. Here’s why integrating HubSpot with QuickBooks through Slipstream might be your ultimate solution:

- Seamless Data Sync: Keep your CRM data in HubSpot and sync it with QuickBooks. No more manual data entry!

- Centralized CRM Management: Manage all your customer interactions in HubSpot while handling payments in QuickBooks.

- Improved Accuracy: Reduce errors by having a single source of truth for customer and payment data.

- Enhanced Efficiency: Automate workflows between HubSpot and QuickBooks, saving time and boosting productivity.

- Comprehensive Insights: Get a holistic view of your business by combining CRM and financial data.

- User-Friendly Setup: Slipstream makes it easy to set up and start integrating without a steep learning curve.

Which One Should You Choose?

It really boils down to your current setup and needs.

- Choose HubSpot Payments if:

- You’re already using HubSpot CRM.

- You want a seamless integration within your sales and marketing tools.

- You don't need real-time financial reporting for day-to-day decisions.

- Choose QuickBooks Payments if:

- You’re a QuickBooks user.

- You need robust accounting and financial tracking.

- You want versatile payment options, including mobile payments.

- Choose Slipstream Integration if:

- You want to leverage the strengths of both HubSpot and QuickBooks.

- You need a seamless way to manage your CRM and payments in one integrated workflow.

- You aim for efficiency and accuracy by syncing data between your CRM and accounting systems.

Final Thoughts

Both HubSpot Payments and QuickBooks Payments have their strengths. Think about your current tools, your needs, and where you want to streamline your workflow.

Still not sure? Maybe give both a try and see which one feels right for you. And if you’re leaning towards integrating the best of both worlds, Slipstream might just be your answer.

Happy payment processing!